Are you sitting down? If not, find a seat. Because this quarter’s national leasing market update isn’t pretty.

We’re going to talk through some interesting charts below. But, (spoiler alert) no matter where we looked — days on-market, leads per on-market period, and rent reductions — it’s all going the wrong way.

Days on Market Snap Back Above Historical Numbers

Nationwide, market times are the highest they’ve been since we started collecting data in 2017.

That’s not to say we haven’t seen worse markets… because we have. But just because the market’s not as bad as 2008 doesn’t make it feel better, especially given how good 2021 was.

The chart below lays out the gory details:

What stands out to us is August 2023 market times which were 26% longer than in August 2022 and 40% longer than in August 2021.

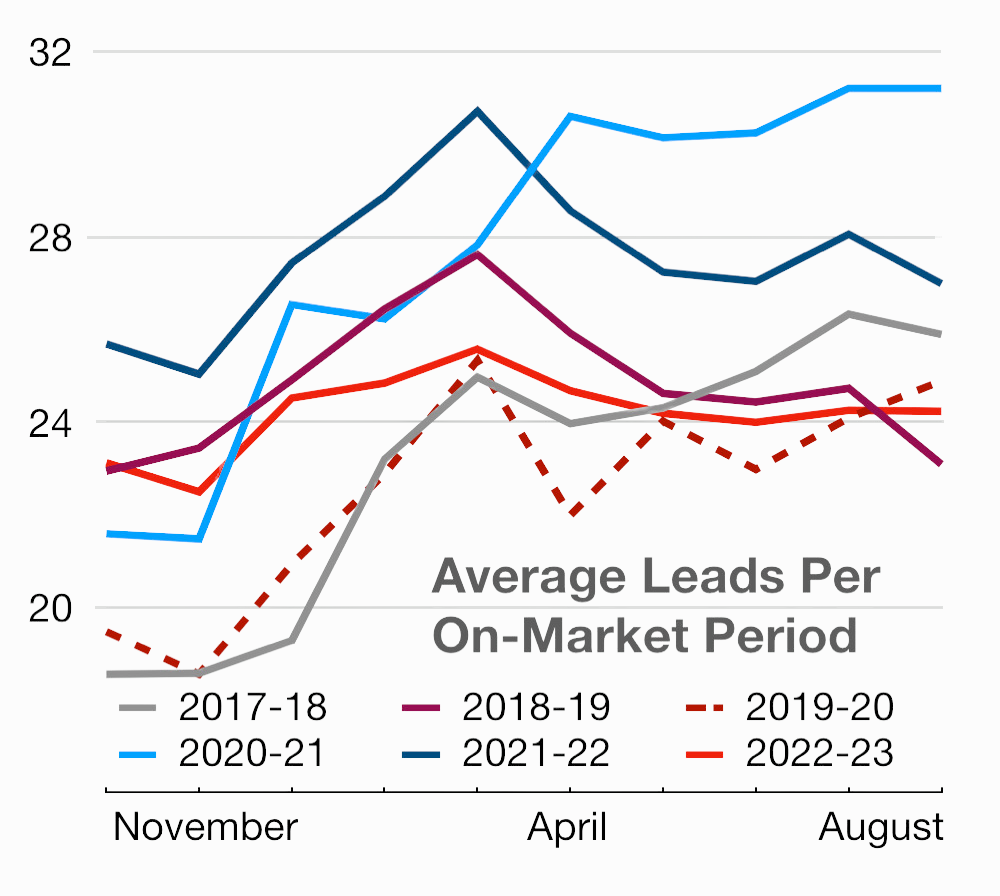

Historically Low Leads Per On-Market Periods

Another way we like to analyze the market is by tracking leads per on-market periods. Unfortunately, this chart paints a picture that’s equally as gloomy as the first one.

Leads per on-market period in August 2023 were 10% lower than in August 2022 and 22% lower than in August 2021. And overall, there’s been a clear deterioration since November 2022 (when you look at year over year trends by month).

When it comes to lead flow, the only August with worse performance that we see is in 2019. Historical ShowMojo data does suggest there was a market dip starting in late 2019. As we all know from history, that was interrupted by the pandemic, and we all know how that ended.

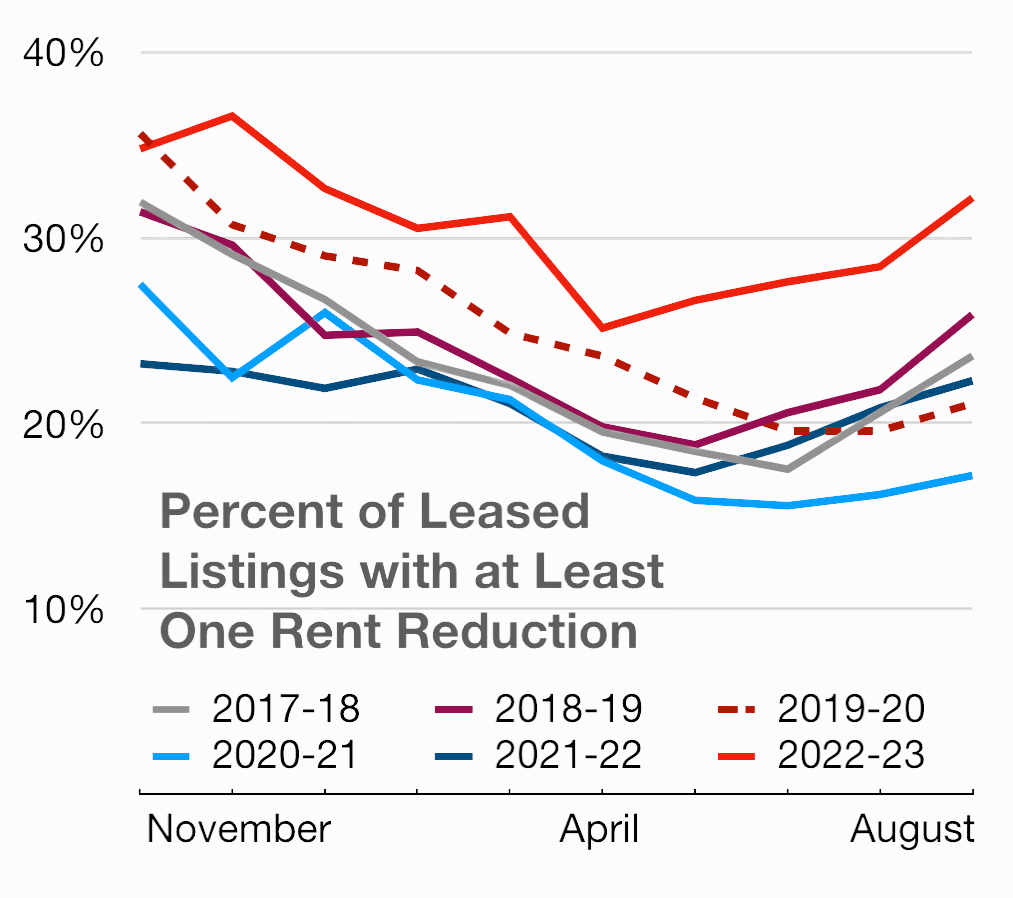

Owners and Managers Playing Catch-up

This last chart’s going to hurt. But then we’ll get to some actionable steps that (might) make you feel a bit better. So hang in there.

This chart shows the percentage of leased listings with at least one rent reduction. Notice that rent reductions in August are the highest they’ve ever been, by a pretty (un)comfortable margin.

Rent reductions in August 2023 were 45% higher than in August 2022 and 88% higher than in August 2021. Yikes.

Unfortunately, the increase in rent reductions isn’t new. They’ve been ticking up for a year now, and we’ve been sounding the alarm in each of this year’s previous quarterly updates.

Despite this, there’s been a persistently optimistic mentality among owners and managers that this is going to get better. We think this is a misunderstanding of the fact that the market is softening.

The bottom line: the market is going to give back at least some of the gains it made from 2021 to 2022.

Winter Is Coming

Ok. It’s not the zombie apocalypse. However, these market headwinds are going to make this winter months difficult. Overall, we don’t see things changing in a positive way for at least nine months.

Even though August 2019 market times were arguably just as bad, they quickly bounced back by 2020. This was thanks to the pandemic-era stimulus, low household debt levels, suspended student loan payments, and historically low-interest rates.

The pandemic stimulus is through the system. Household debt is back to historically high levels. Interest rates are at their highest since before the Great Recession. Student loan repayments are resuming. And the cherry atop that very unhealthy sundae is this — competition is increasing with short-term rentals and second homes being converted back to long-term rentals.

Our advice? Everyone needs to get back to the basics. Return to leasing best practices — and leverage automation. That includes solid marketing content that attracts renters, instant replies to every inquiry, and prospect nurturing that converts renters to signed leases.

If you’re not a current ShowMojo user, we can help with that.

Where’s This Data Coming From?

The data and graphs here come from more than half a million successful residential leases facilitated through ShowMojo. That’s nationwide activity across all housing types and broken down by urban, suburban and rural zip codes.

Did you find this interesting? We certainly did. And we have a ton more to share. Sign up for a complementary leasing data talk and get actionable data and tips about how best to improve your leasing game.